As I’ve written previously, Bitcoin and other cryptocurrencies aren’t just risky assets for those who own them: risk in the financial sector impacts all of us. For Slate, I wrote about Wyoming’s push to lure blockchain companies into the state, and how an obscure banking law from the 1860s gives small states like Wyoming outsize power in our financial landscape. If you prefer video to text, you can hear me discussing this article with Sam Seder on the show Majority Report on NBC’s streaming service Peacock (I don’t think you need a Peacock account to watch the show from a browser, but you may need a Peacock account to watch…

-

-

How bankers get away with breaking the law

For Slate, I wrote about CashCall vs. CFPB, a case where a subprime lending tycoon systematically broke laws of states like Virginia, New York, and North Carolina that make it illegal to charge sky-high interest rates. In most states with anti-usury laws, if you give out an illegal loan, the borrower isn’t obligated to pay any of the loan back: therefore, the Consumer Financial Protection Bureau argued that CashCall should have to refund all the interest it collected to consumers as restitution. CashCall argued it didn’t realize it had broken any laws (lol…), and judges seem to have found this argument persuasive.

-

The view from glass towers

For The New Republic, I wrote about how euphemism, jargon, and data science all help bankers at places like Capital One distance themselves from their customer’s pain. When I talk about “pain,” here, I mean a few different things. Consumers turn to credit cards because they can’t afford what they want or need: a condition that is intrinsically uncomfortable. In some cases, credit cards may help the consumer a little bit, in other cases, they make the financial instability Americans face even worse: in both cases, that suffering is ignored.

-

New visions for banking

For The Outline, I sat down with the founders of the Pagan Credit Union project to hear about their aspirations for the financial sector. People who want to start ethical alternatives to big banks are up against significant obstacles. According to data from the National Credit Union Administration, we lost about 800 credit unions from 2014 to 2018.

-

What it’s like to be a subprime debt collector

For TalkPoverty, a publication of the Center for American Progress, I interviewed subprime debt collectors about their difficult role as intermediaries between Americans in dire financial straights, and the financial institutions posting big profits.

-

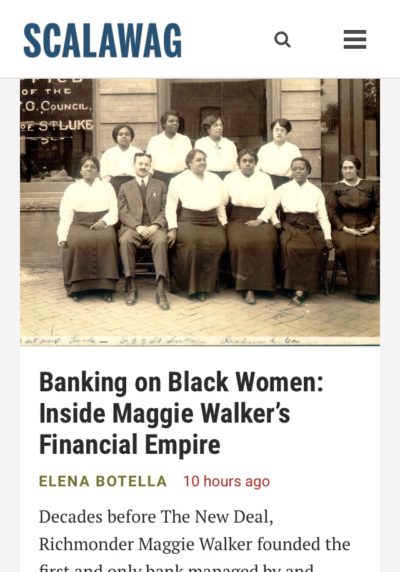

Inside Maggie Walker’s financial empire

In reviewing Shenette Garrett-Scott’s new book “Banking on Freedom: Black Women in Finance Before the New Deal,” one of the most intriguing pieces for me was exactly how St. Luke’s Bank, America’s first bank founded by black women, was able to use social information to improve their underwriting and uplift their community. When “fintech” talks about using social network information, it normally seems like a workaround for people from wealthy communities to ‘skip to the front of the line’ before they have their own track record of responsible financial behavior. But St. Luke’s Bank was closely tied to a fraternal order, the Independent Order of St. Luke, that brought together…

-

The space between want and need

I’m now on Day 13 on my road trip at my aunt and uncle’s farm in Blue Earth County, Minnesota — today is the first day of the planting season for corn. It’s getting a late start because of all the rain. My next stop will be in Iowa. If there’s one comment that has come up in most of my interviews with the people who wished they hadn’t borrowed money on a credit card, it’s that they used the card for things they realized they “didn’t really need.” That word “really” hints at the notion that there is actually a lot of ambiguous space in between want and need.…

-

“The wealth continues to circulate within white cultures and white groups:” Reflections on diversity and inclusion in banking

In last week’s episode of a Me and a Bunch of White Girls, Laura, a diversity and inclusion consultant, described how her experiences in the financial sector motivated her to tackle D&I work: America has so many problems, and this [lack of diversity] is one of them. We continuously keep these spaces so white. [….] Especially in the financial industry, there’s not enough black and brown people. The wealth continues to circulate within white cultures and white groups. Black and brown people aren’t making it into these spaces to influence where the money flows, or to get the money themselves. Obviously, those who want to dismantle capitalism itself would critique…

-

Banks should measure their social impact

In a column for the American Banker, I’ve shared my thoughts on the ‘why’ and ‘how’ of using analytics to make banks more socially responsible.

-

What’s happening with consumer financial protection around the world

In the United States, there hasn’t been much positive policy action on consumer financial protection recently, at least not at the federal level. But regulators and policy-makers in the United Kingdom, Australia and Singapore have been trying a range of solutions, some incremental and some radical, to make life better for borrowers in their countries. You can read more in my post for the Duke Global Financial Markets Center’s FinReg blog.