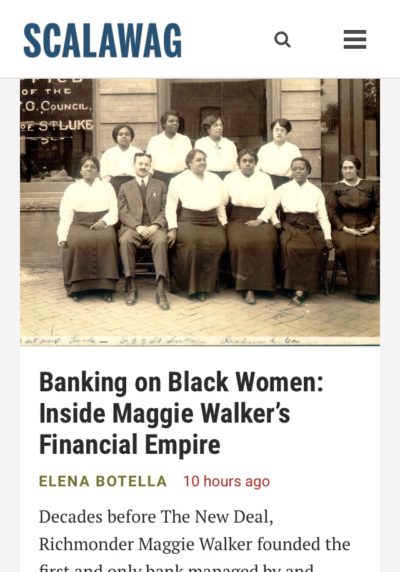

In reviewing Shenette Garrett-Scott’s new book “Banking on Freedom: Black Women in Finance Before the New Deal,” one of the most intriguing pieces for me was exactly how St. Luke’s Bank, America’s first bank founded by black women, was able to use social information to improve their underwriting and uplift their community. When “fintech” talks about using social network information, it normally seems like a workaround for people from wealthy communities to ‘skip to the front of the line’ before they have their own track record of responsible financial behavior. But St. Luke’s Bank was closely tied to a fraternal order, the Independent Order of St. Luke, that brought together…

-

-

“The wealth continues to circulate within white cultures and white groups:” Reflections on diversity and inclusion in banking

In last week’s episode of a Me and a Bunch of White Girls, Laura, a diversity and inclusion consultant, described how her experiences in the financial sector motivated her to tackle D&I work: America has so many problems, and this [lack of diversity] is one of them. We continuously keep these spaces so white. [….] Especially in the financial industry, there’s not enough black and brown people. The wealth continues to circulate within white cultures and white groups. Black and brown people aren’t making it into these spaces to influence where the money flows, or to get the money themselves. Obviously, those who want to dismantle capitalism itself would critique…