For Forbes, I dug into a disturbing trend: workers being asked to sign “Training Repayment Agreements” to repay the (putative, highly inflated, and sometimes completely fabricated) cost of their on-the-job training if they quit or are fired within a set time period. In some cases, the TRAs take 3 years or longer to expire, and can involve $70,000 or more in debt.

-

-

Wyoming Wants to Be the Crypto Capital of the U.S.

As I’ve written previously, Bitcoin and other cryptocurrencies aren’t just risky assets for those who own them: risk in the financial sector impacts all of us. For Slate, I wrote about Wyoming’s push to lure blockchain companies into the state, and how an obscure banking law from the 1860s gives small states like Wyoming outsize power in our financial landscape. If you prefer video to text, you can hear me discussing this article with Sam Seder on the show Majority Report on NBC’s streaming service Peacock (I don’t think you need a Peacock account to watch the show from a browser, but you may need a Peacock account to watch…

-

Investment Firms Aren’t Buying All the Houses. But They Are Buying the Most Important Ones.

You may have read in The Wall Street Journal or elsewhere about the trend of investors buying up single-family homes. For Slate I did a deep-dive by reviewing the financial records of the largest home buyers and uncovered an important point: investors like Invitation Homes (a spin-off of private equity company Blackstone) don’t buy homes at random. They’re really buying up smaller, more affordable housing in growing cities like my hometown of Charlotte: in other words, the specific homes that could have been wealth-building for the working class. An interesting point about many of the giant asset managers that are buy these houses is that they’re not just managing the…

-

My Advice To People Who Want To Quit Their Jobs

Over the last few days, I have been thinking about the choices that police officers, Facebook employees, and employees of the federal government have made about their employment: whether to quit or to stay. They joined these organizations believing they were harmless, or maybe good, and came to question those assumptions. Speaking about the police specifically, the decisions and statements made by union leaders elected by police officers in Minneapolis, New York, and other cities, make it obvious that the problems in policing don’t boil down to “a few bad apples.” I found the statements of Lt. Bob Kroll, head of the Minneapolis police union, at a Trump rally last…

-

What Hurricane Harvey can teach us about the failure of federal disaster policy

For Vice, I traveled to Houston to figure out why Hurricane Harvey caused the credit scores of homeowners in low-income neighborhoods to drop by an average of 24 points. Nearly two years after America’s biggest rain event, Houston’s wealthy neighborhoods have fully bounced back, while lower-income residents, systematically denied relief, were left poorer and sicker.

-

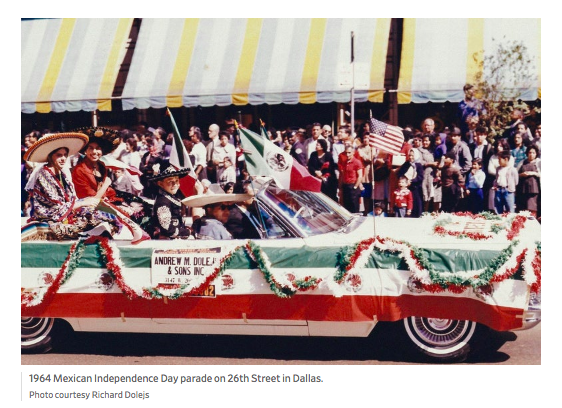

Who really saved the American city?

For Slate, I reviewed A.K. Sandoval-Strausz’ new book Barrio America. Just decades ago, American cities were in steep decline. Eighteen of the United States’ 25 largest cities were smaller in 1980 than they were in 1950. Grim urban landscapes faced depopulation, high crime rates, municipal bankruptcies, and economic decline. Conventional wisdom says the “creative class,” some combination of bohemian artists followed by white-collar yuppies, deserves credit for reversing the tide, making downtowns attractive, if expensive, places to live, a reversal that dampened the congestion, alienation, and environmental catastrophe of the suburbs. Not so fast, says Sandoval-Strausz.

-

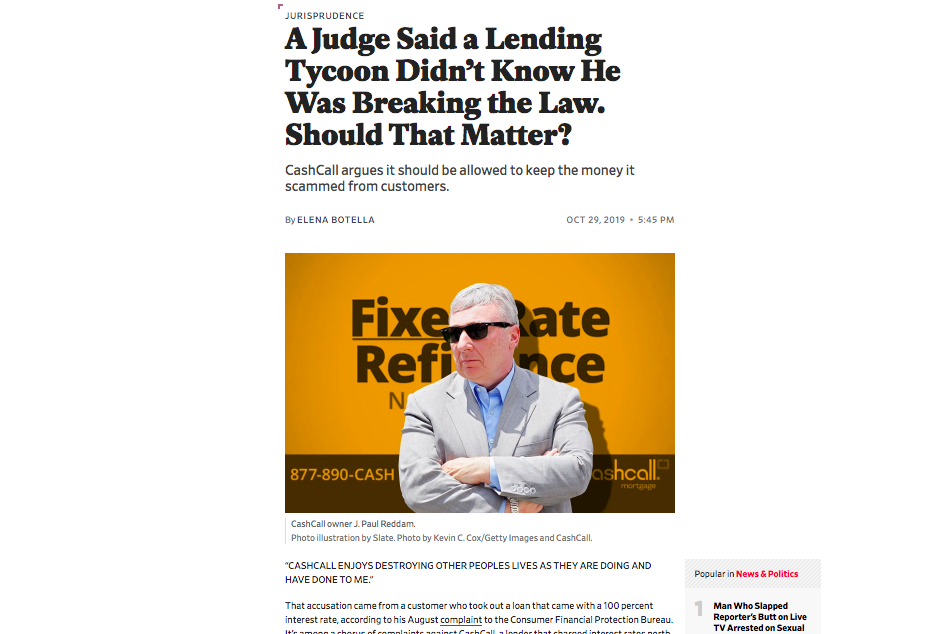

How bankers get away with breaking the law

For Slate, I wrote about CashCall vs. CFPB, a case where a subprime lending tycoon systematically broke laws of states like Virginia, New York, and North Carolina that make it illegal to charge sky-high interest rates. In most states with anti-usury laws, if you give out an illegal loan, the borrower isn’t obligated to pay any of the loan back: therefore, the Consumer Financial Protection Bureau argued that CashCall should have to refund all the interest it collected to consumers as restitution. CashCall argued it didn’t realize it had broken any laws (lol…), and judges seem to have found this argument persuasive.

-

The rich don’t just have more stuff

For The Nation, I interviewed philosopher Jennifer Morton about her new book Moving Up Without Losing Your Way: The Ethical Costs of Upwardly Mobility. Morton explains the rich don’t just have more stuff — capitalism also forces them into fewer dilemmas about whether to prioritize their own interests, or those of their loved ones.

-

The view from glass towers

For The New Republic, I wrote about how euphemism, jargon, and data science all help bankers at places like Capital One distance themselves from their customer’s pain. When I talk about “pain,” here, I mean a few different things. Consumers turn to credit cards because they can’t afford what they want or need: a condition that is intrinsically uncomfortable. In some cases, credit cards may help the consumer a little bit, in other cases, they make the financial instability Americans face even worse: in both cases, that suffering is ignored.

-

New visions for banking

For The Outline, I sat down with the founders of the Pagan Credit Union project to hear about their aspirations for the financial sector. People who want to start ethical alternatives to big banks are up against significant obstacles. According to data from the National Credit Union Administration, we lost about 800 credit unions from 2014 to 2018.