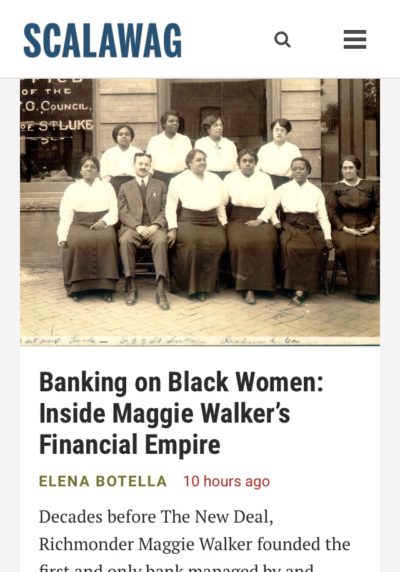

In reviewing Shenette Garrett-Scott’s new book “Banking on Freedom: Black Women in Finance Before the New Deal,” one of the most intriguing pieces for me was exactly how St. Luke’s Bank, America’s first bank founded by black women, was able to use social information to improve their underwriting and uplift their community. When “fintech” talks about using social network information, it normally seems like a workaround for people from wealthy communities to ‘skip to the front of the line’ before they have their own track record of responsible financial behavior. But St. Luke’s Bank was closely tied to a fraternal order, the Independent Order of St. Luke, that brought together washerwomen, tobacco rollers, along with nurses teachers, and white-collar professionals for community service, activism, and collective care. When St. Luke’s Bank turned to the IOSL for information about their borrowers, they were tapping into a social network that had actively built solidarity across working class, middle class, and wealthier black families. It made possible the idea that social connections could signify something greater than inherited class privilege.

You can read more in my review for Scalawag Magazine.

In road trip news, I’m currently in beautiful San Luis Obipso. Will be camping tonight near Santa Barbara, before heading to San Diego and Phoenix.